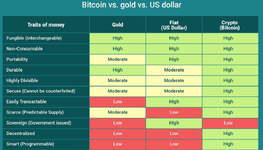

Andy, you comment on the crypto/bitcoin threads everytime they crop up with such authority but your knowledge of them is still extremely limited. All of those things you are debating you are using the general terms and not the specific terms you would use to describe an asset. The $ is less durable because cash is not durable. It can be destroyed. Even the digital version of $ can be destroyed because you can delete any databases, your bank can go bust and your money is gone etc. It just no longer exists.

Security has nothing to do with whether you can remember your login details but how easy it is for someone to move your money without your permission. Forgetting your details is the most extreme example of security. You can't access it but neither can anyone else. It will stay there forever. That's not the case with $ which can be confiscated, frozen, hacked etc. Nobody that owns gold in any serious quantity actually owns it. Someone else owns it and they keep a record that you own x amount of it. That gold could still be stolen or those records deleted.

Gold isn't scarce, not at all. It's hard to get to but there is loads of it. Look outside of our planet and it is everywhere. It's not inconceivable that we will be able to access it at some point.

"In our solar system alone, there is an asteroid between Mars and Jupiter named 16 Psyche that scientists believe contains more than 700 quintillion dollars in gold and other precious metals. Considering today's gold price that is $63,039 per kg, this becomes around 11 trillion tons of gold."

You also don't seem to understand the concept of divisibility. If we need more $ we print more $, we don't divide it. That means the value of $1 is reduced every year due to inflation. Bitcoin can't be created beyond it's cryptographical limit of 21m. If more people want bitcoin they have to buy it from the existing supply.

Bitcoin is decentralised. Nobody can control it individually. The fed is in control of the $. They can print as much as they want, they implement policies that affect the supply of the $. Nobody can do that with bitcoin. You are confusing the price of bitcoin and the dollar with the supply. The price of bitcoin, gold, the $ or anything else is based on supply and demand. Nobody can really control the demand on any of them but the fed can control the supply of the $. If demand get s too high, they just print more. If bitcoin demand gets too high then the price goes up.

Bitcoin "winning" doesn't need all other cryptos to "lose". That doesn't even make sense. You can have loads of different cryptos doing loads of different things running simultaneously. Same way you can have the $, the £ and all the other currencies alongside Gold, Silver and any other physical asset and all sorts of other businesses like VISA, Mastercard, Paypal doing financial transactions and all the other businesses doing things like contracts, securities etc.

None of this of course means it is worth investing in but your post on this topic, as usual, is chock full of misinformation and ignorance.

It's just an opinion, similar to what most investors who don't hold much crypto think.

My limited knowledge is seemingly proportional to your faith that they're going to get used in a meaningful way anytime soon. Like I mentioned, I've got a small amount of crypto though, as the greater fool thing does seem to work well.

That's the thing though, most people who hold crypto will have very little clue about what it is or does, that's not a good thing, and plays into the hand of those who can game the system/ volatility.

The table I quoted seems to have terrible knowledge of currencies and wealth stores we've been using for 100's of years.

The dollar is practically digital, about 0.000001 of my wealth/ cash is in the UK physical form/ £ etc. I've actually got about 10 more currencies in physical forms than I do pounds, as I intentionally do not carry or want cash.

Bank databases are backed up many, many times, in multiple places I expect, never mind the records that the individual can keep. I keep 7-10 years worth of statements, as well as all the records from trading platforms etc, I need these for self assessment so that's good enough proof for me. Each account protected by the FCA up to 85k, so I keep funds in separate places.

Nobody can move my money, from any account without 2FA, I've deemed that more than safe enough, and could go safer if I wated to. The money in the bank is insured, and the bank is regulated by the FCA, nobody is breaking in and stealing my share of the banks cash. If someone writes their crypto wallet/ access codes down then it's a security risk, it's even a risk if stored on a computer or if stored in a encrypted file. The protection people have over their login info is a lot less secure than how banks protect their login info. How many have their crypto details wrote down on a bit of paper, my guess is most.

What happens if coinbase goes bust or whatever? Aren't the general public unsecured and not insured/ protected? What happened when FTX went bust? There seems to be a lot of crypto scams about, but there are scammers in everything.

$ get confiscated and frozen when crimes have been committed, that's a good thing. Not being able to do that with crypto is a bad thing, as it opens the door to illegal activity. Drug dealers would use it more if it wasn't so volatile.

You're using what is off our planet as an excuse that Bitcoin is better than gold (I'm not saying gold is a good investment mind)? The sum of every rock ever brought back to earth by man is < 500kg I think, ever, and all of that has come from the moon (don't think that has any gold). We've never sent anything to Mars which has came back, never mind Jupiter which is 7x further. If we got gold back from mars it would be the most expensive gold ever recovered, by a hell of a long way. Probably a million an ounce, rather than the $2,000 an ounce it costs here.

It's easy to invest a $ in the entire world (extremely diversified) and beat inflation by 6%.

Large bitcoin holders can really effect the price, 0.01% of them have 60% apparently? Nakamoto invented it and supposedly has a stash of a million bitcoins apparently, and nobody knows who that is do they?

Sure the US gov can print money, doing this comes in handy though times of struggle, this is a good thing. They can also take dollars out of the system, which can also be a good thing. Despite printing loads of $ during covid, the value of the dollar has remained pretty similar v other countries, largely as they printed money too.

If one main crypto does get some use then either the others will fail immediately as potential in the others dies, or they all go up and then later fail when people still realise they have no use. For them all to "win" they need absolutely monumental use. By win, I mean taking over major currencies in the world for actual use and there at least 10 currencies which are obviously massive and used daily all over the world. They're going to be harder to shift.

I thought the idea of smart contracts seemed good a few years back, for like with Ethereum, but the problem is they're too volatile for big ongoing contracts which have tiny margins. Also, what happens in a dispute or one person says they met the criteria and others say they don't? Project bank accounts often get used now with big contracts, like on construction etc, these can take away risk for one side, and not really increase the risk of the other, could be difficult to beat those.

www.nicehash.com

www.nicehash.com